From Canadian ISD: Understanding the $20 Million Bond Issue

By CISD Superintendent Lynn Pulliam

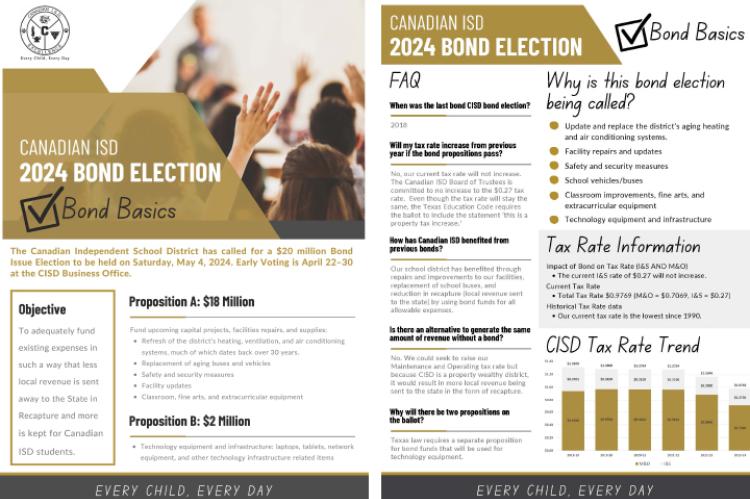

The Canadian ISD Board of Trustees has called for a $20 million Bond Issue Election to be held on Tuesday, May 4, 2024. Early voting will run from April 22 to April 30 at the CISD Business Office.

The objective of the proposed bond propositions is to fund existing expenses in such a way that less local tax revenue is sent to the State in the form of recapture, and more of the local revenue is used to serve Canadian ISD students. The 2024 Bond Proposal comprises two key propositions:

- Proposition A ($18 million): This segment focuses on capital projects, facility repairs, and supplies. It includes an overhaul of our heating, ventilation, and air conditioning systems, many of which date back over three decades. Additionally, funds will be allocated for the replacement of aging buses and vehicles, safety enhancements, facility updates, and procurement of essential equipment for classrooms, fine arts, and extracurricular activities.

- Proposition B ($2 million): Dedicated to technology equipment and infrastructure, this proposition aims to equip Canadian ISD with modern tools essential for education in the digital age, including laptops, tablets, and network infrastructure.

It is important to note that this is our school district’s first bond election since 2018. For the past 5-plus years, the bonds approved in 2018 have been used for facility repairs, improvements, buses, and equipment for classrooms and programs. CISD has a history of paying off bonds early to reduce the amount of interest paid.

Canadian ISD currently has an I&S tax rate of $0.27, which will not increase if the bond propositions pass. Our current overall tax rate of $0.9769 is CISD’s lowest tax rate in over thirty years. If the bond propositions pass, it will not cause the tax rate to increase from our current rate. However, the Texas Education Code requires the ballot to include the statement ‘This is a property tax increase’ on the ballots for both proposition A and B.

As stated above, previous bonds have been used for facility repairs, improvements, buses, and equipment for classrooms and programs. Without bond funds, Canadian ISD would rely on the M&O tax rate to generate the needed revenue for those types of projects. However, increasing the M&O tax rate would have the effect of increasing the amount of local tax revenue sent to the State in the form of recapture. By using bond funds to meet those needs and using the I&S tax rate to service the bonds, Canadian ISD’s recapture is reduced, and more local money is kept in our district serving local students.

In summary, the upcoming bond propositions, if passed, will fund an update to the district’s aging heating and air conditioning systems, buses to safely transport students, safety and security measures, facility repairs and improvements, essential equipment for classrooms, fine arts, and extracurricular activities, and technology equipment and infrastructure. Passage of the bonds will not result in an increase in the school tax rate from the current rate, which is the district’s lowest tax rate in over thirty years.

If you have questions regarding the CISD bond election, please feel free to call me at (806) 323-5393.

FOR MORE INFORMATION:

https://www.canadianrecord.com/school-news/canadian-isd-calls-20m-bond-election-may-4