Canadian ISD board seeks voter approval in special Nov. 8 tax rate election

TO OUR READERS:

In a special election to be held in conjunction with the Nov. 8 general election, Canadian ISD officials are asking voter approval for a proposed combined tax rate of $1.1646 in fiscal year 2022-23.

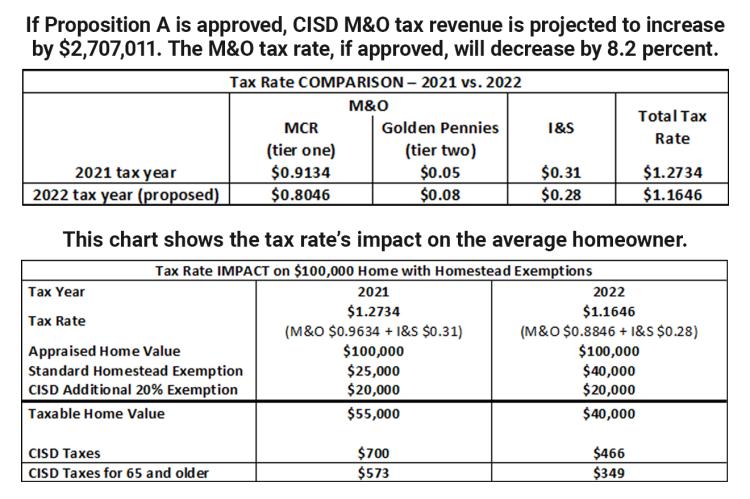

The new tax rate will generate 32.6 percent more in Maintenance and Operations (M&O) revenue for the district, if approved, but the M&O tax rate will actually be 8.2 percent lower than last year’s rate.

Because Texas’ formula for funding public education is complex, we have provided school officials this space to clarify tax rate proposal in detail, to answer questions from taxpayers, and to solicit additional questions if more information is needed.

The information on the following pages was prepared by the Canadian ISD Board of Trustees and Superintendent Lynn Pulliam, and is published here at no cost to CISD or its taxpayers.

Laurie Ezzell Brown, publisher

A MESSAGE TO CISD VOTERS

The Canadian ISD Board has ordered a special election for the purpose of a voter-approved tax rate election to be held on Nov. 8. CISD has set the overall 2022 tax rate at $1.1646. Even though this tax rate is reduced by almost 11 cents from the 2021 CISD tax rate of $1.2734, a voter-approved tax rate election is required because the board added three golden pennies to the maintenance & operating (M&O) portion of our tax rate.

Due to the complicated nature of school rates, I will attempt to clarify and inform so that voters know exactly how the tax rate will impact their own situations, as well as the school system, and I will strive to keep my explanations and illustrations as simple and straightforward as possible.

Below, I have included the ballot language for Proposition A, which states that the increase in M&O tax revenue, if approved, would be $2,707,011. As the ballot states, if approved, this would be a 32.6 percent increase in tax revenue; however, the M&O tax rate, if approved, will decrease by 8.2 percent from the 2021 rate.

Below the ballot language, I have included two tables. The first table shows the breakdown of the 2022 CISD proposed tax rate and the 2021 CISD actual tax rate, while the second table shows the impact on property taxes for a $100,000 home.

The three pennies the board added to the M&O tax rate, which necessitate the tax rate election, are golden pennies, which are higher-yield pennies. If approved, these three golden pennies will add almost $400,000 to the M&O budget. The district intends to use these funds to pay for staff salary adjustments and other operational expenses.

For those of you who desire more information regarding the proposed tax rate and general school-funding information, I have included a CISD tax rate Q&A to address topics and questions regarding school taxes and their impact on public school funding. Unlike other public taxing entities, in which M&O tax revenue collected directly serves the adopted budget, public school tax rates include additional factors that affect school funding. I hope my attempt to clarify school taxes and funding in the Q&A section is sufficient.

If you believe any of the information presented here is confusing or insufficient, please feel free to contact me either through email (lynn.pulliam@canadianisd.net) or by phone (806.323.5393). I welcome your input.

Lynn Pulliam, superintendent of schools

Q&A: CANADIAN ISD'S TAX RATE ELECTION

Q: Will the school tax rate exceed last year’s rate if Proposition A is approved?

A: NO. If Proposition A is approved, the M&O tax rate will be $0.8846 compared to $0.9634 for 2021, and the overall tax rate will be $1.1646 compared to the 2021 overall rate of $1.2734.

Q: If Proposition A passes, how will it affect the taxes I pay on my home compared to last year?

A: For a home appraised at $100,000, with the standard homestead exemption plus the additional 20 percent exemption that CISD applies, the homeowner will pay an estimated $234 less than last year. A homeowner 65 or older with a home appraised at $100,000 will pay an estimated $224 less than last year.

Q: Why is a voter-approved tax rate election needed?

A: When the board adopted an M&O rate that added three golden pennies, the adopted rate exceeded the voter-approval tax rate; thus, a voter-approved tax rate election is required. A school district is allowed to adopt as many as eight total golden pennies as part of its M&O tax rate. CISD added the first five golden pennies with board approval in previous years. Adoption of the last three golden pennies requires a voter-approved tax rate election.

Q: Why are they called golden pennies?

A: They are referred to as golden pennies because they are not subject to recapture, AND the state enriches them through increased funding. Thus, they are worth more than their actual tax levy. With CISD’s current property values, three golden pennies will generate close to $400,000 in additional funding to support the district’s M&O budget, which is used to pay for day-to-day operational costs, such as teacher pay, fuel for buses, and the energy needed to heat and cool our facilities.

Q: Why is the overall tax rate dropping by almost 11 pennies?

A: Because of mandatory tax rate compression, a component of the public-school legislation known as House Bill 3, which was passed by the 86th Legislature in 2019. From 2021 to 2022, Canadian ISD’s compressed tax rate dropped from $0.9134 to $0.8046. A school district’s compressed tax rate is known as its Tier 1 rate. The Tier 2 rate is the enrichment rate, better known as the golden pennies. Together, the Tier 1 and Tier 2 rates make up a district’s total M&O rate.

Q: Why does the school have two different tax rates: I&S and M&O?

A: The Interest & Sinking (I&S) tax rate services debt (bonds). Revenue from the I&S rate is not subject to recapture. Over the years, CISD has benefited greatly from bonds through construction projects, facility upgrades and repairs, buses, maintenance equipment, and many other items that have lifespans greater than one year. One hundred percent of I&S tax revenue stays in the district to pay off the bonds used to fund the capital items listed above. Because CISD is a property-wealthy district, maximizing bonds to pay for allowable items has saved the district millions of dollars. The board adopted a 2022 I&S rate that is 3 cents less than the 2021 rate.

The Maintenance & Operating (M&O) tax rate generates revenue that determines our total state funding based on the weighted average daily attendance of our students. As stated in the answer to the question above, the M&O rate has two tiers. Tier 1 is the maximum compressed rate (MCR), which is determined by the state based on property values and the state’s attempt to provide property tax relief and pick up more of the cost of funding schools. The amount of recapture the district sends to the state is based on the Tier 1 rate revenue. Tier 2 is the enrichment rate, or golden pennies. These pennies are not subject to recapture and are enriched through the state funding formula.

Q: You keep using the term “recapture.” What does recapture mean exactly?

A: Recapture refers to the redistribution of tax revenue from property-wealthy school districts to property-poor school districts to equalize per-pupil education funding. Since recapture was implemented in 1993, CISD has paid close to $120 million dollars to the state. The term “recapture” was changed during the 86th Legislature to Revenue in Excess of Entitlement.

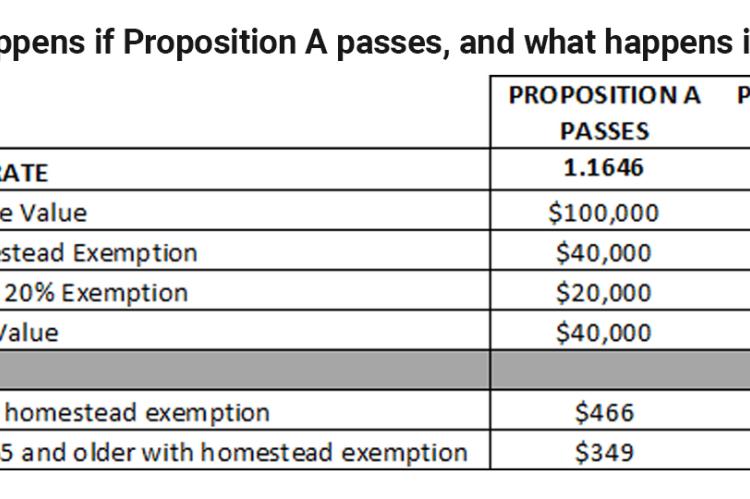

Q: What happens if the CISD tax rate election fails?

A: If Proposition A fails and the board adopts the voter-approval tax rate of $1.1346, a homeowner with an appraised value of $100,000 and allowable homestead exemptions will pay $12 (twelve dollars) less than if the election passes. The district’s 65-plus homeowners would pay $9 (nine dollars) less for a $100,000 home. This table (see below) shows the actual impact of the resulting tax rates for those with homestead exemptions if Proposition A passes compared to if Proposition A fails: In this scenario, CISD will still pay the same amount of recapture but will receive approximately $400,000 less in state funding.

SCHOOL TAX RATE FACTS

MAINTENANCE AND OPERATING TAX RATE (M&O)

•Funds the district’s M&O budget (salaries, fuel, energy costs, supplies, etc.).

•Made up of two tiers.

1) Tier 1 Tax Rate: Maximum Compressed Rate (MCR)

•Set by the state—it accounts for state and local property value growth.

•Tax revenue is subject to recapture (money paid to the state for tax revenue in excess of entitlement based on student enrollment and weighted average daily attendance).

2) Tier 2 Tax Rate: Golden Pennies

•Tax revenue is NOT subject to recapture (the local tax revenue is kept in our own school system).

•Enriched by the state (worth more than their tax levy, thus these are “golden” pennies.

•Eight golden pennies in total are available to school districts (five with board approval and three through a tax rate election). Presently, CISD has approved five golden pennies, and if Proposition A passes, the tax rate election will result in an additional three golden pennies.

INTEREST AND SINKING TAX RATE (I&S)

•Services our debt (bonds)—may only be used for capital expenses (construction, facility repairs, buses, items with life spans greater than one year).

•Not subject to recapture.

ADDITIONAL INFORMATION

If the proposed M&O tax rate is approved, Canadian ISD is projected to receive almost $400,000 in additional state funding. The district intends to use the increased revenue for staff salaries and the day-to-day operations of the district.

Tax Rate Compression—As a result of House Bill 3 from the 86th legislative session, M&O tax rates are subject to tax rate compression laws that factor in both state and local property value growth and establish a district’s maximum compressed tax rate (MCR), also known as the M&O Tier 1 tax rate. In 2021, the CISD MCR was $0.9134. In 2022, the CISD MCR is $0.8046.